Featured

What retailers can learn from the Barbour jacket to thrive in the eCommerce sphere

The global online retail sphere is poised for substantial growth, with analysts forecasting a staggering $8.1 trillion by the end of 2024

Insights

Why generational leadership is to thank for the success of leading retailer, Costello’s Ace Hardware

Family owned by the Costello family for more than 50 years, Costello’s Ace Hardware (Costello’s Ace) offers an extensive range of products and services...

Over the course of 50 years, Cycle Gear has evolved to be a pillar in the riding community

Celebrating 50 years in business this year, Cycle Gear provides motorcyclists with quality gear, parts, and accessories combined with unparalleled customer service

Classic designs and contemporary flair continue to define Ashley Wilde Group’s success as it announces a brand-new art-inspired homeware range

From subtle florals to vibrant jewel-toned silks, Ashley Wilde Group offers only the best soft furnishings and fabrics to leading homeware brands across the...

With hundreds of leading lifestyle brands, CLF Distribution offers UK retailers a comprehensive choice

For over 25 years, CLF Distribution (CLF) has been a one-stop shop for climate-conscious consumers in the health and wellbeing market

How Abercrombie & Fitch Co.’s supply chain brings the business closer to its customers

Abercrombie & Fitch Co. (A&F Co.) is a leading, global specialty retailer of apparel and accessories for men, women, and kids through five renowned...

Family-owned pharmacy and convenience store chain, Lewis Drug, goes above and beyond to support local neighborhoods

For over 82 years, Lewis Drug has been the first stop for trusted local convenience. With a rich history, dating all the way back...

Listen to the latest podcast

Brand Strategy

Classic designs and contemporary flair continue to define Ashley Wilde Group’s success as it announces a brand-new art-inspired homeware range

From subtle florals to vibrant jewel-toned silks, Ashley Wilde Group offers only the best soft furnishings and fabrics to leading homeware brands across the...

With hundreds of leading lifestyle brands, CLF Distribution offers UK retailers a comprehensive choice

For over 25 years, CLF Distribution (CLF) has been a one-stop shop for climate-conscious consumers in the health and wellbeing market

How Abercrombie & Fitch Co.’s supply chain brings the business closer to its customers

Abercrombie & Fitch Co. (A&F Co.) is a leading, global specialty retailer of apparel and accessories for men, women, and kids through five renowned...

The Top 9 Pick-Up and Delivery Services in America

Whether it's a crucial document that needs to reach its destination overnight or a week's worth of groceries delivered right to your doorstep, these...

Tickets on sale now. Food Network stars, Grammy-winning musicians, and 500+ chefs will come together February 22-25, 2024

Tickets are officially on sale for one of the biggest, most star-studded, and delicious wine and food charity festivals in the country: the 23rd...

Superdry Reveals ‘Milestone’ Partnership in Formula E

A groundbreaking collaboration has emerged as Superdry joins hands with Envision Racing. This partnership, commencing from Season 10 of the FIA Formula E World...

Etsy Revolutionizes Gift Shopping with AI-Powered ‘Gift Mode’

Etsy, renowned for its unique and creative marketplace, has long been a go-to platform for those seeking original and personalized items. From handcrafted jewelry...

Franchising

Living colorfully

Crayola and Brooklyn-based retailer, Casely, are to collaborate on a new collection of tech accessories with designs influenced by the brand that embodies color

Wild Birds Unlimited Inc

Since its inception, Wild Birds Unlimited Inc has been determined to create an environment of education and peace for its bird-watching customers

Is franchising all it’s hyped to be?

Achieving the promise of franchise ownership. By Robert Purvin

Clean Juice

One of America’s fastest-growing (and only) organic juice bar operators, Clean Juice’s USDA-certified outlets offer healthy, organic food and beverages to on-the-go guests across...

Stores

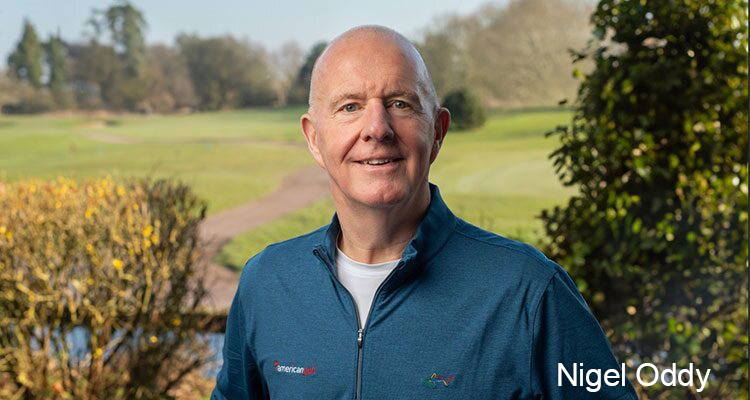

Through resilience and determination, American Golf has redefined the golf retail landscape

With currently 88 stores across the UK and Ireland, American Golf is the UK & Europe’s largest golf retailer, offering a one-stop shop for...

Why generational leadership is to thank for the success of leading retailer, Costello’s Ace Hardware

Family owned by the Costello family for more than 50 years, Costello’s Ace Hardware (Costello’s Ace) offers an extensive range of products and services...

Over the course of 50 years, Cycle Gear has evolved to be a pillar in the riding community

Celebrating 50 years in business this year, Cycle Gear provides motorcyclists with quality gear, parts, and accessories combined with unparalleled customer service

How Abercrombie & Fitch Co.’s supply chain brings the business closer to its customers

Abercrombie & Fitch Co. (A&F Co.) is a leading, global specialty retailer of apparel and accessories for men, women, and kids through five renowned...

Family-owned pharmacy and convenience store chain, Lewis Drug, goes above and beyond to support local neighborhoods

For over 82 years, Lewis Drug has been the first stop for trusted local convenience. With a rich history, dating all the way back...

Rats, Recalls, and a 1,000 Closures: Troubles at Family Dollar

Dollar Tree Inc. has recently announced a significant restructuring move, planning to close nearly 1,000 of its Family Dollar stores across the United States....

The Silent Surge of Organized Retail Crime

In recent years, the retail industry has been grappling with a formidable and elusive adversary: Organized Retail Crime (ORC). Unlike the sporadic shoplifter, ORC...

Sustainability

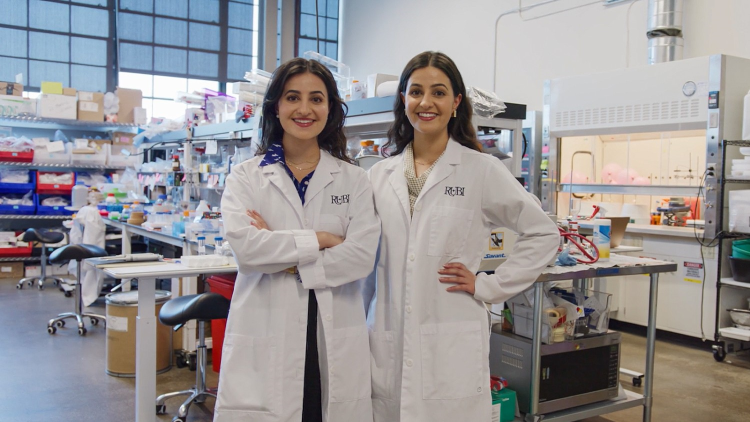

Discover KMI Brands’ ambitious path to redefining the beauty industry

Celebrating 30 years in the beauty business, KMI Brands is an esteemed brand and beauty creator.

Symbiotic manufacturing could breathe fresh air into supply chains

In a first-of-its-kind partnership, Walmart is collaborating with Rubi to pilot innovative technology to reimagine supply chains.

Costco and Engenera to enter solar market

Costco Wholesale has joined forces with Engenera Renewables Group, one of the UK’s leading renewable energy companies.

7 retail companies investing in renewable energy

In recent years, there has been an increasing focus on sustainable and renewable energy, and many companies have been investing in green alternatives.

Harrods takes a seat for sustainability

Harrods, the luxury department store, has been working closely with Veolia on a new initiative to support its sustainability strategy.

Alibaba.com records a huge drive in demand for sustainable products among UK B2B buyers

It would appear consumers’ consciences are focusing on climate change, and they’re expecting brands to do the same.